Introduction

Harvard’s endowed funds support a vast array of academic and operational activities central to the University’s mission of teaching, learning, and research. Harvard Management Company (HMC) invests these funds to ensure that this critical resource benefits current and future generations of students, faculty, and scholars.

For decades, Harvard has worked to address the urgent threat of climate change. In 2020, Harvard expanded these efforts by committing to achieve net zero greenhouse gas (GHG) emissions for its endowment portfolio by 2050 consistent with its fiduciary duty to manage risk and pursue superior long-term investment returns for the entire portfolio. Harvard Management Company (HMC) reports annually on progress toward this goal, as well as other climate-related efforts.

This report provides an update on HMC’s work to implement the University’s net zero commitment through measuring its financed emissions, investing in climate solutions, and developing analytics to assess the intersection of climate impact and commercial opportunity. Data in this report are current as of June 30, 2024, the end of HMC’s most recent fiscal year. Past Climate Reports are available on the HMC website.

$16B

estimated investment emissions

A net zero portfolio is consistent with HMC’s duty to manage risk and pursue long-term investment returns.

path to net zero

Measuring Financed Emissions

HMC continues to speak with external asset managers (GPs) to promote the University’s net zero commitment. HMC also seeks improved data coverage from its GPs to calculate the financed emissions of the portfolio. These efforts are critical to measuring progress toward net zero, as well as understanding the climate impact of certain investment strategies.

Past reports have detailed the challenges for establishing methods to measure the greenhouse gas emissions associated with a diversified endowment portfolio. For example, HMC has significant investments in private companies, which lag public company peers in reporting emissions data. Additionally, no broadly accepted carbon accounting standards exist for certain investment strategies

widely used by hedge funds. A central focus of HMC’s sustainability program is instituting suitable protocols. Currently, HMC is able to estimate financed emissions (measured in tons of CO2 equivalent or “tCO2e”) for approximately 32% of the endowment (asset class coverage is detailed in the appendix).

HMC has seen a significant improvement in private equity (PE), where certain managers now provide self-reported data. With more managers committing to future reporting, as well as broader industry initiatives driving disclosure, HMC expects a further increase in GHG data for the PE portfolio in 2025 and beyond.

The progress achieved this year resulted from HMC’s concerted effort to engage with GPs

in the PE portfolio.

This work affirmed that:

- Increasing data reporting is critical to improving GHG data quality and coverage. Company-measured GHG data reported by GPs is of substantially higher quality than modeled data. Modeled data relies on public company proxies, which conveys little information about a company’s real-world impact.

- The ESG Data Convergence Initiative (EDCI) has helped to improve emissions data collection and reporting in the PE industry, particularly for the buyout segment. The EDCI was founded in 2021 and HMC joined the following year.

Industry engagements

HMC engages with industry participants on both carbon accounting methodologies and net zero alignment for alternative investment strategies. HMC continues to study methods for measuring progress on these two metrics outside of standard emissions reporting.

Serving as a resource for, and engaging with, other endowments is a priority for HMC’s sustainable investing team. To accelerate the collective progress to a net zero future, HMC hopes to lead where it can while learning from others who are taking innovative steps.

HMC’s primary goal is to achieve strong, long-term, risk-adjusted returns for the University. This goal is a paramount consideration in any investment strategy that HMC pursues, including climate solutions.

Climate Solutions Investments

HMC recognizes that reducing GHG emissions can promote strong economic development on a global basis. Achieving these objectives requires acting within the evolving market and public policy environment. While the long-term trajectory for reducing GHG emissions has improved since the Paris Agreement of 2015, the global economy has yet to reach a path to net zero.

HMC continues to invest in funds and companies that actively reduce greenhouse gas emissions, scale climate solutions, and enhance climate resiliency. Additionally, HMC has identified potential investment opportunities in nuclear fission and natural gas power plants that leverages carbon capture, utilization, and storage to reduce or eliminate emissions.

Over the past year, the opportunity set of climate-related investments has broadened to include climate resiliency. For example, more managers are investing in climate adaptation, such as flood monitoring technologies and wildfire solutions. Other managers are developing proprietary risk tools to monitor physical climate risk in their own portfolios.

As a limited partner, HMC engages with external managers on climate transition to ensure that its GPs identify sector-specific risks and understand how to scale solutions within industries. HMC seeks to understand the potential impact of changing regional and global policies, as well as increasing competition for talent in new hard tech.

Over the past four years, as part of its overall investment strategy, HMC’s total commitments to funds focused on climate solutions have increased. Relationships with managers have enabled both direct investments into funds, as well as co-investment into funds’ portfolio companies. With climate tech moving with the broader venture capital market, maturing portfolio companies are appearing in the portfolios of some of the endowment’s generalist managers. As a result, HMC’s climate transition investments now account for 1.5% of NAV. In contrast, the endowment’s exposure to private equity funds focused on the exploration and development of fossil fuels has declined over the past five years to roughly 1.2% of NAV.

Sufficient capital formation is necessary to move critical climate technologies from early development phases to commercialization and expansion. Significant aspects of the economy will require reengineering, optimization, and novel technologies to successfully decarbonize. HMC's portfolio is positioned to benefit from the growth and market leadership of these businesses.

The path to decarbonization will not be a linear descending slope. It seems clear that these businesses and technologies have the potential to make a transformative impact on the climate crisis. However, the benefits—both for the climate and for investors—may not be realized in the near term. Most of these technologies are expected to take years, or even decades, to be developed and deployed at scale. Any of several factors could affect these trends. In the meantime, the steel, cement, and electricity used by these companies will add to the portfolio’s financed emissions.

Climate solution investments require significant capital and time to scale due to their dependence on infrastructure, regulation, and market adoption. Investors must account for the risks of changing policies and plan for long-term sustainability without unduly relying on government support.

Estimating Climate Impact

The endowment’s net zero work has evolved from solely seeking to measure historical emissions to also assessing forward-looking impact. As a result, HMC began to forecast potential emissions reductions from specific climate solutions technologies.

Potential emissions reductions refer to the GHG emissions prevented or reduced by a project or technology compared to a baseline scenario or incumbent technology. Potential emissions reductions can be measured in terms of either absolute emissions (tCO2e) or relative emissions (percentage reduction). This analysis helps HMC understand the most beneficial emerging climate technologies, a crucial step given the slow pace of global decarbonization, the nascency of some climate solutions, and the stage of companies in much of the climate transition strategy.

All forward-looking assessments are based on significant assumptions. A technology's status as a “solution” depends on both the industry context where it is deployed and its application. Technologies in the endowment’s portfolio will likely be deployed on a global scale. However, actual technology usage in different geographies and economic regions will affect avoided emissions outcomes. Such assessments will only be estimates. Despite this, HMC believes forward-looking estimates and reporting will provide a better measure of climate impact than GHG emissions measurement made after the fact. Forward-looking estimates allow HMC to more directly evaluate its climate strategy. It is difficult to understand the transition looking only through the lens of historical data.

Over the past year, HMC worked with a third-party service provider to calculate the potential emissions reductions of five technologies in its climate solutions portfolio. This exercise provided a better understanding of certain technologies in the portfolio operating at the intersection of climate impact and commercial considerations. The following model for Microbial Nitrogen-Fixing Biofertilizer is one example.

Based on the model’s calculations, by 2030, this specific technology could avoid 12 million metric tons of CO2e per year. This calculation is derived by applying a per unit impact of 0.13 million metric ton (Mt) CO2e/million hectares of cropland that employs the new technology (versus synthetic nitrogen fertilizers) and multiplying by a market size of 1,900 million hectares and a market penetration rate of 4.8%. With U.S. agriculture emitting an estimated 663.6 million metric tons of CO2e in 2022 (46.6% nitrous oxide), climate solutions for soil management are a meaningful part of decarbonizing a high emitting sector of the economy.

While this project is still in its early stages, it highlights strategies that HMC could employ to analyze its net zero progress. In the coming year, HMC will study more technologies and conduct a company-level analysis, and continue to look for opportunities to engage with Harvard faculty and other scholars with relevant expertise on GHG measurement and net zero alignment.

Carbon Neutral Operations

HMC’s operations have been carbon neutral since fiscal year 2022. To neutralize unabated emissions for fiscal year 2024, HMC continued to purchase and retire voluntary credits for carbon dioxide removal (CDR). More information on HMC’s methods of CDR is available in the 2024 Climate Report.

Making Progress...

While the challenges of decarbonization can seem daunting, it is important to recognize that progress is being made.

1.

According to a report by Accenture, 55% of the world’s 2000 largest companies (by revenue) have reduced their operational emissions since 2016, 77% have reduced their emissions intensity, and 30% are deploying 15 or more decarbonization levers. In addition, in Europe, 64% of all companies have full GHG emissions targets and 54% of banking companies have full GHG emissions targets. These numbers reflect modest improvements from 2023.

2.

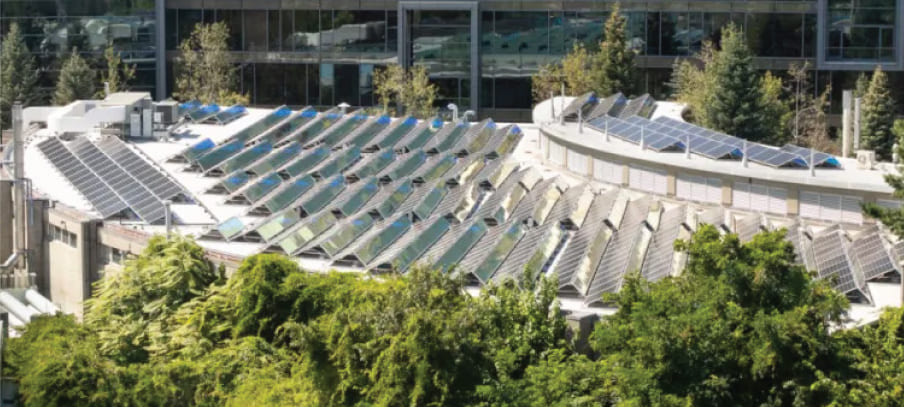

In 2024, about 560 gigawatts of solar panel capacity was installed. That is an annual record and a nearly 30% increase from 2023. In the U.S. alone, about 42 gigawatts of solar capacity was installed, a 25% increase from 2023.

3.

As a global investor, the financed emissions of the endowment are closely correlated with the emissions of the world’s developed economies. In the ongoing pursuit of more and better data to assess progress toward net zero, HMC is mindful that positive changes in the global economy remain the main driver of GHG emissions improvements in the portfolio today.

... But Not Fast Enough

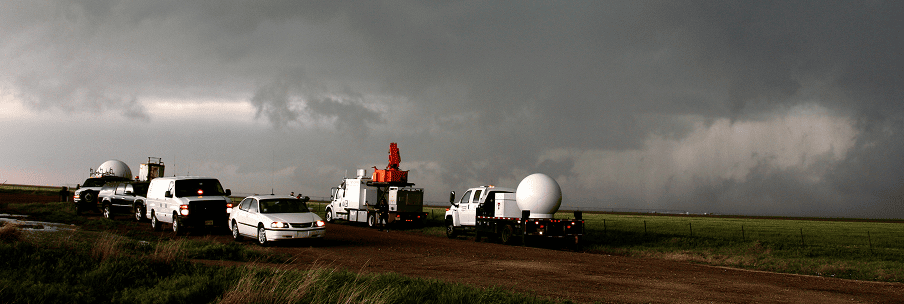

In 2024, the U.S. experienced 27 confirmed weather events with losses exceeding $1 billion each. Overall, these events resulted in the deaths of 586 people and significant economic effects to the impacted areas. Most recently, the total damage and economic loss from the January 2025 California wildfires has been estimated to be between $250 and $275 billion. As climate stability declines, society needs to re-engineer existing infrastructure and fortify assets and communities against the effects of changing earth systems.

HMC is in the early stages of considering how to best evaluate physical climate risk in Harvard’s portfolio. Physical climate risk often resides in companies' supply chains, whether in sourcing raw materials, manufacturing and production of key components, transportation and logistics, or the health and safety of workers. HMC plans to examine current and forward-looking climate risks in more detail, specifically for the portfolio’s exposure to real estate and natural resources.

While HMC has made progress toward calculating the endowment’s GHG footprint, the urgency of this work continues to increase. This years-long effort has resulted in measurable improvement. Despite our progress, HMC will need to complete further research to achieve greater clarity on the timeline to produce a reasonable estimate of financed emissions across the entire portfolio. Rather than being a deterrent from this work, this fact serves as motivation for HMC to increase the rate of progress toward aligning the portfolio with a realistic and achievable net zero pathway. Incorporating climate-related risks and opportunities in prudent investment analysis and decision making is aligned with our mission to help ensure long-term risk-adjusted returns to support and expand Harvard’s leadership in education and research for future generations.

Metrics & targets

Financed Emissions Data Coverage

HMC includes company Scope 1 and 2 emissions in measuring the endowment’s financed emissions. Generally, HMC plans to follow the TCFD framework and Partnership for Carbon Accounting Financial (PCAF) standards for calculating the portfolio emissions. However, for reasons discussed in the main body of this report, HMC is approaching the process carefully and expects to ultimately adopt an approach and methodology tailored to HMC’s investment program.

Following TCFD guidance, HMC considered using weighted-average carbon intensity (WACI) as a measure of its portfolio’s exposure to carbon-intensive companies. For several reasons, going forward, HMC plans to shift its data collection to measuring financed emissions.

Financed emissions are emissions generated as a result of financial services, investments, and lending by investors. They are measured in tonnes of CO2 equivalent (tCO2e) and calculated by attributing a portion of a company or activity’s carbon footprint to an investor. Financed emissions are covered in the Greenhouse Gas Protocol Scope 3 Guidance and fall under Category 15. For more information, see the Partnership for Carbon Accounting Financials (PCAF).

WACI uses revenue or sales to normalize emissions. As such, WACI is helpful in comparing companies within sectors and across asset classes. However, WACI can be misleading when comparing companies across sectors because of differences in business economics. For example, using WACI, companies with very modest emissions and little or no revenue, such as early-stage biotech companies, have more carbon intensity than highly emitting but profitable companies in the materials or industrials sectors. HMC does not believe that WACI accurately represents the emissions generated by investments in its portfolio. Nor does HMC believe that WACI provides a good roadmap for directing climate reduction efforts.

Using WACI to assess performance may encourage an overly short-term focus, as year-over-year fluctuations are more likely to result from changes in revenue rather than reduced operational emissions. HMC believes that financed emissions is a more appropriate metric for its portfolio as it is easier to understand and less volatile than WACI.

For calendar year 2023, HMC had financed emissions data (tCO2e) for 32% of the endowment. The graphic below shows coverage by asset class.

Progress Towards Reaching Net Zero

Amount of data collected by each asset class

HMC collects emissions data for a portion of its hedge fund investments. Partnering with a third-party service provider, HMC utilizes a custom carbon emissions report to estimate the emissions of hedge funds. Currently, there is data coverage for 33% of the hedge fund portfolio. While HMC remains committed to increasing the number of hedge fund managers participating in this initiative, based on manager feedback, it is unlikely that this approach will result in the desired level of coverage. HMC is also working to develop a framework of principles for determining which hedge fund trading strategies actually finance GHG emissions (e.g., owning and holding equity or debt securities) and which do not (e.g., relative value interest rate swaps). HMC plans to report on the progress of this initiative in a future climate report.

As with previous years, HMC independently collected emissions data for its direct public equity holdings. To calculate emissions for fund positions, HMC relied on accessible manager holdings reports, SEC Form 13F filings, and audited financial statements.

Finally, HMC received manager-reported emissions data for a portion of its real estate assets and the entire natural resources portfolio.